IT'S TIME TO TAKE YOUR CREDIT OFF OF LIFE SUPPORT!

Selvin Financial is here to help you surpass your credit score goals. We specialize in the full credit repair process. Our team of reputable, FICO-certified credit experts will work diligently on your behalf to delete negative items from your credit report with all three credit bureaus (TransUnion, Equifax, and Experian)

IT'S TIME TO TAKE YOUR CREDIT OFF OF LIFE SUPPORT!

Selvin Financial is here to help you surpass your credit score goals. We specialize in the full credit repair process. Our team of reputable, FICO-certified credit experts will work diligently on your behalf to delete negative items from your credit report with all three credit bureaus (TransUnion, Equifax, and Experian)

IS THIS PROGRAM FOR YOU?

GOOD CREDIT WILL OPEN UP MORE OPPORTUNITIES FOR YOU!

At Selvin Financial we make credit repair simple and affordable. Our number one goal is to ensure that our client's accomplish their financial goals. Whether you're buying a home, leasing a vehicle, getting approved for an apartment, seeking business funding, or any other financial goal - the odds are stacked against you with an unhealthy credit profile. Think credit repair is expensive and takes years? Think again, we've simplified the process to provide you with an affordable and seamless experience by the best credit repair specialists serving the market so that you can experience the benefits of healthy credit sooner rather than later.

Buy A New Home

Buy Or Lease A Car

Get Approved For An Apartment

Qualify For A Better Job

Get Approved For A Credit Card

Get Funding For Your Business

SCHEDULE YOUR FREE CALL WITH A CREDIT REPAIR SPECIALIST

DONE FOR YOU CREDIT REPAIR

Selvin Financial takes unhealthy credit profiles and transforms them into powerful “leverage” machines. We do this by analyzing your credit profile and weighing it against your personal financial goals to understand your specific needs. From there we craft an individualized plan of action using our proprietary disputing system, processes, and letters to help you dispute the following off of your profile;

If you fall behind on payments, the lender or creditor may transfer your account to a collection agency or sell it to a debt buyer.

Inaccurate or out of date information like your old addresses or employers could cause your loan/credit applications to get denied.

A single medical debt in collections can harm your credit score by as much as 100 points. And once the debt appears as unpaid on your credit report, it takes up to seven years to disappear.

Repossessions have a severely negative impact on your credit and can show lenders that you may not be able to make payments on the property you purchase.

Anything that companies may consider a legal liability is a matter of public record. It will usually show up on your credit report

A credit inquiry occurs when you apply for a credit card or loan and permit the issuer or lender to check your credit. There are hard & soft inquiries.

Bankruptcy is a legal proceeding involving a person or business that is unable to repay their outstanding debts.

WE HAVE HELPED 60,000+ PEOPLE ESCAPE THE HORRORS OF...

WE ARE ONLY AS GOOD AS THE RESULTS WE ACHIEVE.

60K+

CREDIT PROFILES RESTORED

2M+

DEROGATORY ITEMS REMOVED

9M+

POINTS OF GAINED CREDIT SCORES

WHAT'S INCLUDED?

1: CREDIT REPORT ANALYSIS

Our team of certified credit specialists will review your credit profile to determine the best path to repair your profile. You will then receive a PDF breakdown of your report findings and revealing the steps you need to take and the steps we will take to begin repairing your credit quickly and effeciently.

2: DONE FOR YOU CREDIT REPAIR

After our team has determined the proper methods for disputing your negative items. We will then write and mail our proprietary dispute letters to the bureaus and lenders. From there, we will monitor the results of the dispute and escalate the disputes as necessary in efforts to delete the negative items from your credit profile.

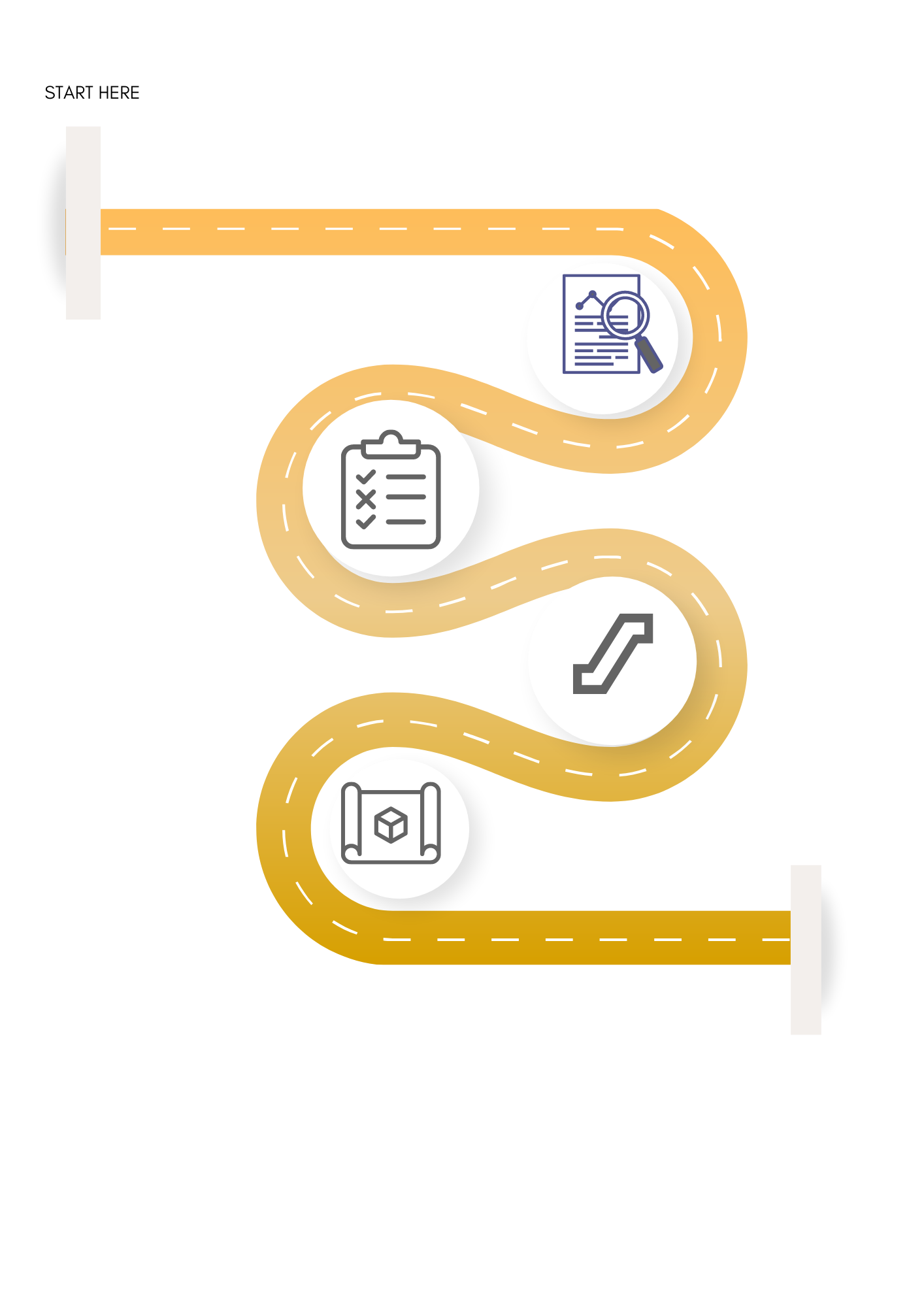

How It Works?

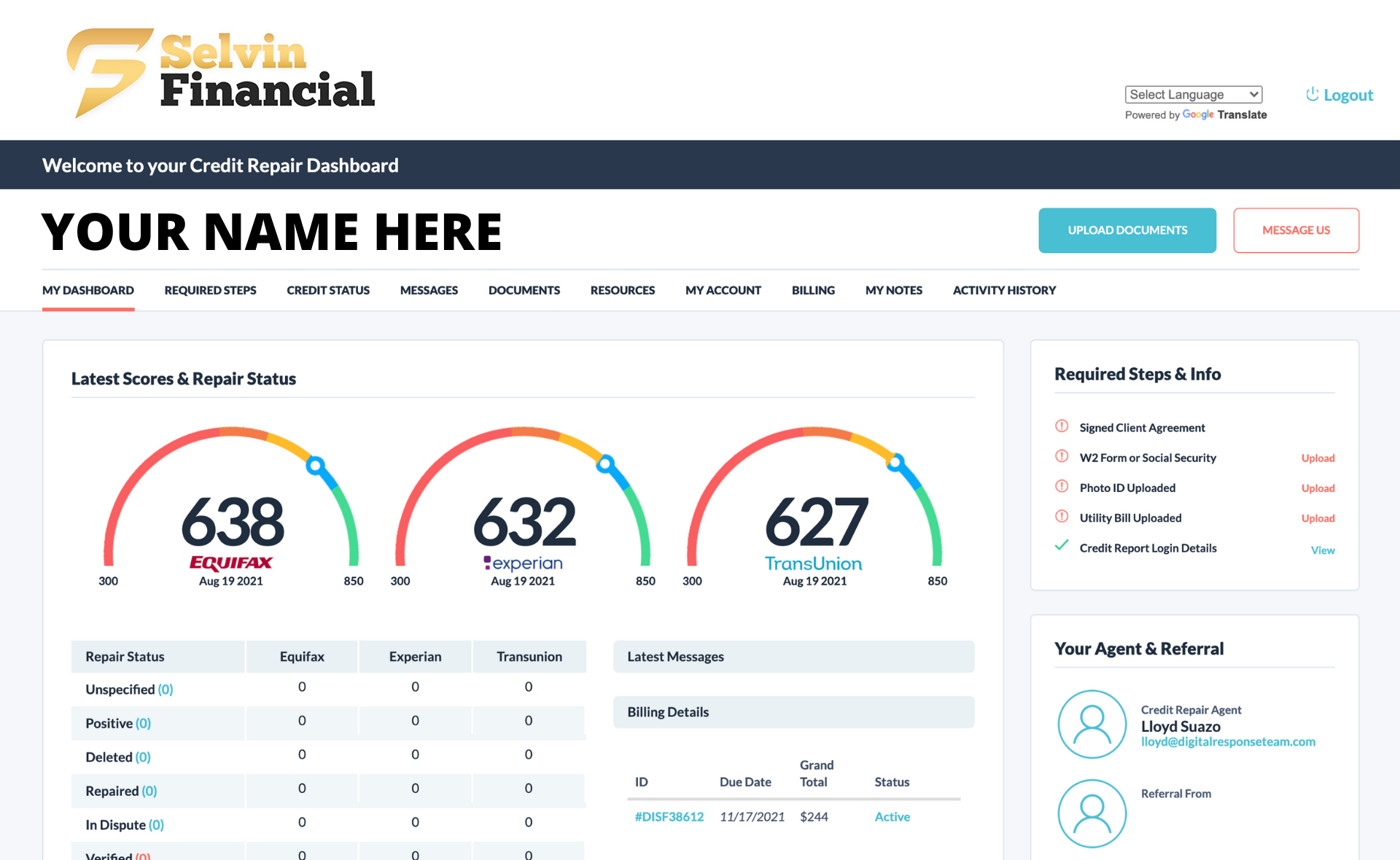

3: SECURE CLIENT PORTAL

You'll have 24/7 access to the Selvin Financial Secure Client Portal where you can check on your credit repair progress, access updates, and also communicate with your assigned credit repair specialist. Our portal brings 100% transparency to the work being done your credit profile.

4: VIP CLIENT CARE TEAM

Have a question? Want an update? You'll have support to our newly revamped client care team. The Selvin Financial Client Care Team is trained to answer your questions and provide guidance during the credit repair process.

1. CREDIT REPORT ANALYSIS

We obtain your credit reports and create a plan targeting the questionable negative items affecting your credit score.

2. CREDIT DISPUTING

Our team will send the appropriate correspondence to dispute and challenge the inaccurate negative items on your behalf.

3. DISPUTE ESCALATING

For negative items requiring additional correspondence, we keep the process going and ensure your credit rights are fairly represented.

4. CREDIT MENTORING

Through the online portal, we offer 24/7 access to your credit score analyses’ and credit counseling resources to help you reach your credit goals. This includes a monthly coaching call and hours of credit education resources.

1. CREDIT REPORT ANALYSIS

We obtain your credit reports and create a plan targeting the questionable negative items affecting your credit score.

2. CREDIT DISPUTING

Our team will send the appropriate correspondence to dispute and challenge the inaccurate negative items on your behalf.

3. DISPUTE ESCALATING

For negative items requiring additional correspondence, we keep the process going and ensure your credit rights are fairly represented.

4. CREDIT MENTORING

Through the online portal, we offer 24/7 access to your credit score analyses’ and credit counseling resources to help you reach your credit goals. This includes a monthly coaching call and hours of credit education resources.

DON'T JUST TAKE OUR WORD FOR IT!

HERE'S WHY CLIENTS ♥️ SELVIN FINANCIAL

DON'T JUST TAKE OUR WORD FOR IT!

HERE'S WHY CLIENTS ♥️ SELVIN FINANCIAL

ARE YOU READY TO UNLOCK THE FINANCIAL OPPORTUNITIES THAT COME WITH GREAT CREDIT?! SCHEDULE A FREE CREDIT CONSULTATION IF YOU ARE SERIOUS ABOUT IMPROVING, MAINTAINING, AND LEVERAGING YOUR CREDIT PROFILE UTILIZING THE MOST EFFECTIVE CREDIT REPAIR PROGRAM ON THE MARKET

START YOUR JOURNEY TO A BETTER FINANCIAL FUTURE

*Please Note: YOU CAN SCHEDULE YOUR FREE CALL WITH A CREDIT REPAIR SPECIALIST

FAQs

There’s no way to predict in advance how long it will take to repair an individual’s credit profile, as every credit report is unique. That being said, last year alone, our clients saw tens of thousands of negative items removed from their reports, and it typically took around 6 months.

Credit repair is never guaranteed. What we can guarantee is that we will do everything in our power to help you achieve a fair, accurate and improved credit report. There are no guarantees or refunds for our credit repair service.

Providing the best service possible is a top priority at Selvin Financial, and if we aren’t meeting your expectations or you no longer need our service, you can cancel at any time by contacting your assigned Credit Repair Specialist. There is no on-going contract. You can request for us to discontinue service at any time.

If you do not or cannot pay our agreed upon payment terms, we will cease your service. Of course, we will reach out to you and try to collect payment, but we cannot provide credit repair services without payment for time rendered.

As we are working with your creditors and the credit bureaus, we’ll notify you of updates to your credit profile via email and our secure portal. When you have items removed or improved, you will see them first on your credit report, which is updated through your credit monitoring service. These updates will be reflected in the secure client portal. To access your account online, use the login information you created during the signup process. If you’re having any problems logging in, or just need additional assistance, feel free to give us a call at (510) 356-2068 or email support@selvinfinancial.com.

Once you’ve reached your credit goals, or when you’re confident your credit report is fair, accurate and substantiated, that may mean you no longer need to actively dispute items on your credit report.

© Copyright 2022 – Selvin Financial, LLC. All Rights Reserved.